Resource • White Paper

HEPATOCELLULAR CARCINOMA: Consider India for your next HCC international trial

Authors: Poltanov, Evgeny MD, PhD, Director of Eastern European Operations, Biorasi; Kelji, Akshay MS, Feasibility Manager, Biorasi; and Panigrahi, Rachana MSc, Feasibility Specialist II, Biorasi.

INTRODUCTION

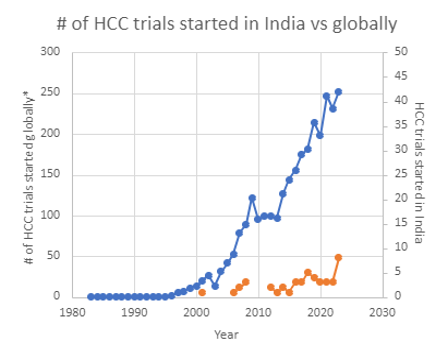

Hepatocellular carcinoma (HCC) is the most common type of liver cancer globally and is the third most common cause of cancer-related death in the Asia-Pacific region [9]. Due to its severity and low survival rate, the overall unmet medical need in HCC remains high. New therapies enter the market each year, focused on improving the survival rate. The increasing number of clinical trials demonstrates significant growth and, according to clinicaltrials.gov, has almost doubled since 2013, reaching almost 250 trials started in 2021 (Figure 1).

The incidence of HCC in India has significantly increased in recent years [6, 10, 15]. Based on Cancer Registries in five Indian urban populations (Mumbai, Bangalore, Chennai, Delhi, and Bhopal), liver cancer ranks as the fifth most frequent cancer for both genders [16]. The annual, age-adjusted incidence rate of HCC per 100,000 persons ranges from 0,7 to 7,5 for men and 0,22 to 2 for women [5, 17]. As estimated by CANCERTOMORROW|IARC, the number of new cases of liver cancer in India from 2020 to 2040 will increase by 62,1% [8].

At the same time, the number of HCC clinical trials conducted in the country is extremely low. India was not included as a venue in most of the pivotal trials that formed the basis of the current HCC treatment except for a few like HIMALAYA (NCT03298451), BRISK (NCT00858871) and EMERALD (NCT03778957, NCT03847428, NCT05301842) trials.

This statistic is in contrast with the involvement of other countries from the Asia-Pacific region (See Table 1) and correlates with historically reported low age-standardized incidence (ASR) rate for HCC as one of the main reasons why India is not considered as a good venue for clinical trials. (Table 1).

Table 1. ASR for HCC and number of clinical trials in Asia-Pacific Region.

1According to clinicaltrials.gov using hepatocellular carcinoma as a main search criterion | But is it really the case and how do perspectives with potential involvement of India in HCC trials really stand? India is the most populated country in the world and one can expect that even with this ASR, the total number of prevalent cases in the country in absolute numbers remains second to China and substantially exceeds that of Thailand, Japan, South Korea and the other countries of Asia-Pacific region. We decided to investigate this matter in more detail and to check what opportunities, with regards to HCC trials, currently exist in India. |

With this purpose in mind, we analyzed epidemiological data, benchmarking and competitive landscape, number of potential sites, standard of care and existing treatment guidelines. Finally, we identified and carried out a feasibility outreach to a list of potential Investigators in India, which included such specialties as Oncologist, Hepatologist and Gastroenterologist, who were found to have experience in treating and carrying out clinical trials for HCC patients. The main purpose of the outreach was to understand the actual scenario in India, challenges faced in terms of patient treatment, what can be done to attract more trials in India and why India can be considered a good venue for HCC trials.

EPIDEMILOGY

Many authors notice that data on the epidemiology of HCC from India are sparse and of variable and uncertain quality [11, 13]. One of the reasons is that cancer is not a reportable disease in India and the cancer registries are mostly urban [17]. Apart from oncologists, HCC is managed by varied specialists like general surgeons, GI surgeons, and gastroenterologists and apparently is not always properly registered.

The historical discrepancy between high prevalence of risk factors and the low reported incidence of HCC can be partly explained by the underreporting of HCC and poor coverage of the entire population [14].

At the same time India, along with China, Korea, Japan, and Thailand, has the highest number of hepatitis B virus-related cases and, along with Thailand and the United States ,the highest number of nonalcoholic steatohepatitis–related HCC cases [1]. The incidence and prevalence of HCC due to the epidemic of non-alcoholic fatty liver disease (NAFLD) is overtaking viral hepatitis in India and becoming the leading cause of liver cancer [2, 3, 4, 7]. According to data reported by Younossi et al. [1] in 2019, Asia accounted for 57,2% of the global prevalent cases and 46, 2% of the global NAFLD liver deaths. These rates were driven by China, India, and Indonesia.

Interestingly, a recent HCC Survey conducted in Kerala, also contradicted a long-believed idea that HCC is uncommon in India [4]. Many authors notice the increased incidence of hepatocellular carcinoma (HCC) [6, 10, 15]. The reasoning not only involves increasing rates of NAFLD and ALD, but also a replacement of biopsy and conventional angiography for diagnosis of HCC with non-invasive methods.

The annual age-adjusted incidence rate of 0,7 to 7,5 for men and 0,22 to 2 for women per 100,000 persons [5, 17, 21] is based on data collected before 2014. Even then, researchers noticed the trend of increases in frequency of occurrence of HCC that was likely to continue. Considering the available literature data, one can expect that the actual HCC rate in India today is substantially higher. More population-based surveys are required to get more precise data on the real incidence of HCC in India.

INDIAN EXPERIENCE IN HCC TRIALS AND ENROLLMENT BENCHMARKING

We identified a total of 26 HCC trials in clinicaltrials.gov, and 17 more trials in CTRI, that totaled 43 unique trials, of which 18 are currently ongoing.

29 of these trials were conducted only in India and sponsored by governmental medical institutions such as All India Institute of Medical Sciences (5 trials), Institute of Liver and Biliary Sciences (4 trials) or local medical centers, for example Tata Memorial Hospital (5 trials). Practically all local trials included just one site, where the body that sponsored the trial also conducted it.

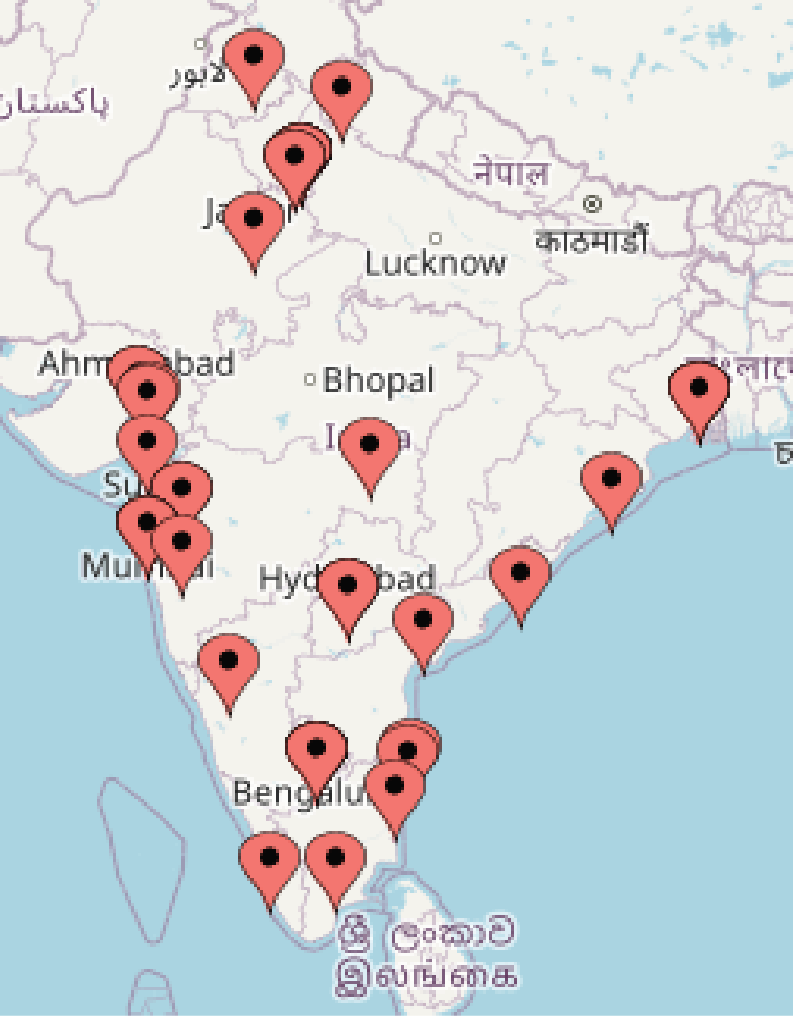

1. Location of Indian HCC sites | The most active sponsors of the international trials were AstraZeneca with 4 durvalumab trials, HIMALAYA (NCT03298451), EMERALD (NCT03778957, NCT03847428, NCT05301842), and Bayer AG with 5 trials including NAVIGATE (NCT02576431), OPTIMIS (NCT01933945) and GIDEON (NCT00812175). In these trials, the number of Indian sites varied from 3 to 18 (9 sites in average per study), that were scattered around the country (Figure 1). |

| The number of HCC trials started in India each year tended to increase in the past 6-7 years (Figure 2). At the same time, it still does not follow the global trend of explosive interest in the disease study that was clearly observed in the last decade.

Almost 70% of conducted trials in India were local when sponsors of international trials were reluctant to consider the country as a potential venue. |

The enrollment benchmarking analyses based on historical data available in ClinicalTrials.gov and CTRI (Table 2) demonstrated that the median enrollment rate of trials that included India as a participating country was comparable with the enrolment rate achieved globally (0,25 pspm for India vs 0,29 for globally resp.) and by other APAC countries.

Table 2 Enrollment benchmarking (median PSPM) in advanced HCC Trials

| Global | India | China | Japan | South Korea | Taiwan | Hong Kong | Singapore | |

| # of CT analyzed | 1864 | 25 | 34 | 17 | 22 | 22 | 16 | 9 |

| Median enrolment rate (pspm) | 0,29 | 0,25 | 0,29 | 0,21 | 0,24 | 0,26 | 0,24 | 0,21 |

Therefore, the Indian involvement in HCC trials continues to remain comparatively low with most of the trials conducted at the local level. At the same time, the existing limited experience of participation of Indian sites in global international trials gives enough evidence that the country could give comparable enrollment contribution equal to that currently given by other Asia-Pacific countries and could also provide good opportunities to international trials.

POTENTIAL SITES

We identified 101 unique sites across India experienced in HCC trials using CTRI and clinicaltrials.gov. Approximately 20 of them have the experience of participating in more than one HCC trial. 80 sites previously participated in international HCC trials.

Table 3 provides details of the most active Indian sites. Two of them – All India Institute of Medical Sciences and Institute of Liver and Biliary Sciences – are also sponsors of local HCC trials, while the others are mainly involved in international trials.

Table 3 Examples of sites experienced in conducting of HCC trials.

| Site Name | Location | # Completed HCC Trials | Phases |

| All India Institute of Medical Sciences (AIMS), Delhi | New Delhi | 4 | II/III, IV |

| B. P. Poddar Hospital & Medical Research Ltd | Kolkata | 3 | III, IV |

| Lakeshore Hospital and Research Centre Ltd | Kochi | 3 | III, IV |

| Institute of Liver and Biliary Sciences | New Delhi | 3 | II, III |

| Medanta-The Medicity | Gurgaon | 2 | III, IV |

| Sanjay Gandhi Postgraduate Institute of Medical Sciences | Lucknow | 2 | III, III |

| Apollo Specialty Hospitals | Chennai | 2 | III |

It was interesting to compare the number of sites available in India with those of other countries in the Asia-Pacific region. Expectedly, the number of potential sites in India is substantially higher than that in Taiwan, Hong Kong or Singapore, but exceeded by such countries as China and Japan (Table 4).

Table 4 Number of HCC sites available globally and in Asia-Pacific region

| Global | India | China | Japan | South Korea | Taiwan | Hong Kong | Singapore | |

| Number of Sites | 5921 | 101 | 695 | 272 | 114 | 50 | 17 | 15 |

These data confirm good and competitive potential for HCC feasibility in India and a good perspective for increase in the number of relevant sites that can be observed in the nearest future.

INVESTIGATOR’S FEEDBACK

To assess Indian feasibility potential, we carried out a corresponding outreach to potential Investigators, with specialization in Oncology, Hepatology and Gastroenterology, experience in HCC treatment and previous involvement in HCC clinical trials. Investigators were identified by searching Indian Clinical Trials Registry [20], ClinicalTrial.gov and scientific publications.

In total, 63 investigators with suitable profiles and clinical trial experience were selected. These investigators were approached by e-mail with a short survey to assess their experience in clinical trials in total and advanced HCC clinical trials in particular, interest in participating in new HCC clinical trials, access to patient populations, current standard of care, economic burden, and potential issues with running HCC clinical trials in India.

The survey was conducted in July 2023, within a 3-week period. After the initial invitation, two follow-up reminders were sent on the second and the third week, respectively. As a result of this approach, 13 completed forms were received.

With some of the investigators, who confirmed their availability, a short follow-up interview was conducted to get more detailed and insightful information on the perspectives of HCC trials in India.

All the respondent Investigators confirmed that they had prior experience in clinical trials from 5 to 30 years, with the number of conducted studies ranging from 2 to 30. However, a majority of them lacked local or International HCC Trial experiences. Only two investigators had experience in international advanced HCC trials (1 and 8 resp.), and four investigators in local Indian trials (3 investigators took part in one trial, and one investigator in eight local trials).

At the same time, all investigators responded positively to having required qualifications, resources and facilities for HCC trials and were looking forward to taking part in them.

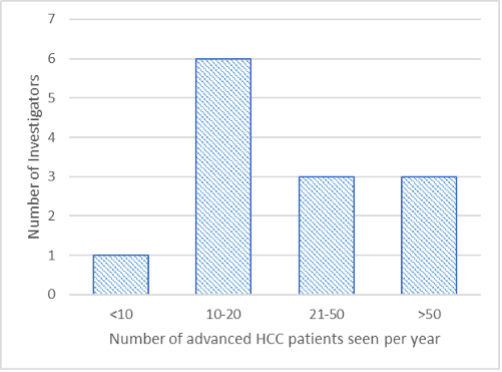

Figure 3. Number of advanced HCC patients seen per year | Most of the investigators saw from 10 to 50 advanced HCC patients per year (nine investigators) (Figure 3). Three confirmed to observe more than 50 patients (up to 100), and just one investigator mentioned to have only six patients per year. Usually, sites also maintained an HCC patient database that included 30-50 patients in average, while two investigators responded to having 300 and 700 patients registered in their databases, respectively. |

Additionally, two investigators noticed a substantial increase in the number of patients diagnosed with HCC, which could be due to increased awareness of the medical community and use of non-invasive diagnostic methods.

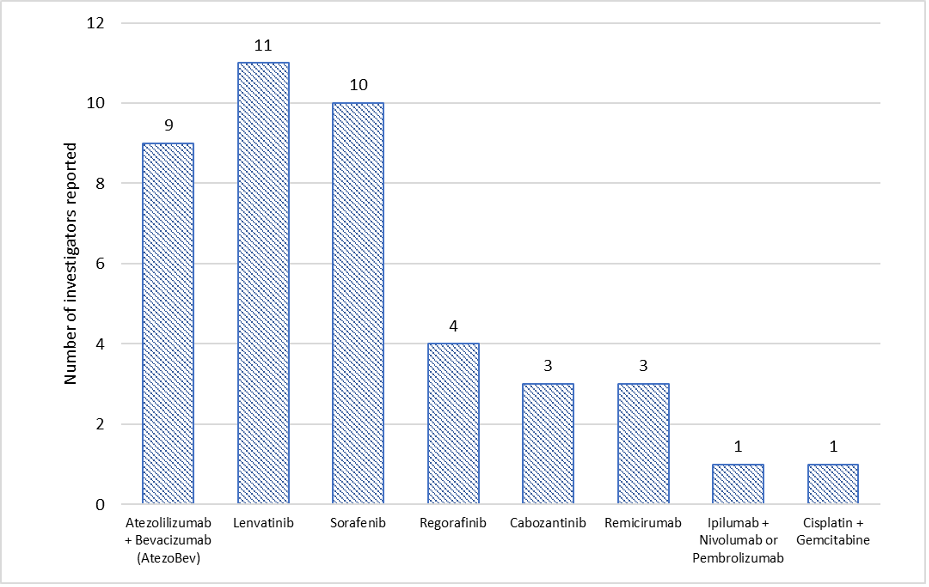

Figure 4 Available treatment for patients with advanced HCC |

Available treatment options were noted to be in line with those of international HCC treatment standards when Sorafenib, Lenvatinib and Atezo/Bev are accessible to most patients (Figure 4). Some investigators also confirmed they administered regorafenib, cabozantinib, remicirumab, and ipilumab with Nivolumab or pembrolizumab, while one investigator even mentioned the use of cisplatin and gemcitabine scheme.

All 13 investigators agreed in the opinion that HCC bears a huge economic burden on the patients and their caregivers, as the treatment is not currently reimbursable by the government and only partially covered by medical insurance. This is in line with data provided recently by L.-T. Chen et al. [12] that only about 30% of HCC patients are covered by “government insurance.”

Interestingly, most of the investigators struggled to identify any potential specific hurdles in conducting advanced HCC trials in India. Respondents only noted some general concerns quite typical for any trial, such as convincing patients to participate in the trial, regulatory approval timelines, low awareness of the disease in medical community, and patient proximity.

DISCUSSION

Despite its large population, India’s contribution to the global clinical trials has averaged at ~4% per year from 2010 to 2022 [26] and was also always lagging compared to other Asian countries like China and Japan. Thus, the study of S. Selvarajan et al. found that in the year 2011, India contributed to only 4,2% of the total clinical trials registered, compared to 7,5%, 9,7%, 17,6% by Australia, China, and Japan respectively [25].

In the case of NASH trials, an important role was played by historically reported low age-standardized incidence (ASR) rate for HCC and a perception that sees India as a venue with confusing legal regulations, lack of research infrastructure, and lack of clinician awareness about the importance of clinical research trials [22, 26]. A noticeable decline in the number of conducted clinical trials in India in 2010-2013 was presumably associated with an increase in reported clinical research mishaps, negative media and professional press coverage, and stagnation of the regulatory process [24].

One can assume that such historical perceptions continue to have an impact today when a company decides to involve India as a potential venue. At the same time, most of the quoted epidemiology data are based on data received almost 10-15 years ago, which, even then, was noted as underestimating the real state of HCC prevalence in India. Since 2014, the country has witnessed an increase in the number of conducted clinical trials. Following the new regulations, the number of sites increased by 40% between 2014-2022 and the number of investigators has doubled since 2015 in the top pharma sponsored trials in India [26]. New drug and clinical trial rules went into effect in 2019 and further improved the regulatory transparency, the approval process and patient safety surveillance.

The Indian healthcare system has also made significant positive progress in recent years, particularly in terms of expanding access to healthcare services and improving health outcomes [29]. The Indian National Association for the Study of the Liver (INASL) published its guidelines on the diagnosis and treatment of HCC in 2014; these were subsequently updated in 2019 and 2023. The current version offers a comprehensive framework for the diagnosis, staging, and management of intermediate and advanced HCC in India, that keeps up with the latest developments for the treatment of the disease [28]. This was also confirmed during our survey, when most of the investigators used AtezoBev, Sorafenib, Lenvatinib with potential access to Cabozantinib, Regorafenib and Ramucirumab.

Late reporting of patients, due to the existence of a well-known problem, inadequate patient screening or delay in routine tests when curative treatment is not possible [4, 6, 7, 18], in combination with worldwide accepted treatment standards, make Indian patients good candidates for potential advanced HCC trials.

It is also interesting to note that the number of potential clinical sites and estimated enrollment rate that for Indian Investigators was comparable and in certain cases even exceeded that of other countries from Asian-Pacific region that were more actively involved in HCC trials. All polled investigators were very interested in attracting new HCC trials in the country and confirmed to follow considerable number of patients annually while maintaining the applicable database for them as well.

The low number of HCC trials currently conducted in the country means low competition for patients that bear an economic burden and are motivated to get access to innovative treatment.

All the data collected strongly suggests a good country perspective in the involvement in future HCC trials, due to the size of the patient pool, treatment standards, availability of potential sites and comparable enrollment data. At the same time, we should keep in mind the relatively low level of experience of a majority of Indian investigators when conducting international trials that may require more detailed feasibility approach and additional educational efforts upon study initiation.

Considering the above growth of HCC trials in India, it seems that India will provide future opportunities for international sponsors to extend their trial’s geography with subsequent benefits from a diverse population, low competition, and motivated investigators.

SPECIAL THANKS

We would like to thank all of the investigators who provided their valuable feedback by responding to the feasibility questionnaire, with special thanks to Dr Abraham Koshay and Dr. Kaushal Patel who agreed to provide additional information related to the HCC scenario in India which added valuable information to the white paper.

We would also like to thank Dr. Sagar Patil, and Dr. Abhijit Damre for providing their valuable comments and their review of the HCC white paper.